Card processing

Trifinity Merchant Services

Card Processing

This Website is for the training of Trifinity Agents ONLY, so Agents can understand what they need to know.

Agents Will Learn:

- What Card Processing is, how Card Processing works, and what Sales Agents can expect to earn;

- The 3 types of Card Processing: Traditional Card Processing; Credit Card Surcharging; and Cash Discounting;

- Trifinity’s “New Card Concept”;

- The Different Types of Card Processing Machines;

- The History of Card Processing.

What is Card Processing?

Card Processing is the process a Business Owner uses to take Card Payments for a purchase.

This process is regulated by the Card Networks, sometimes called a Card Association. Visa®, Mastercard®, American Express®, Discover®, are all examples of Card Networks/Card Associations.

Card Networks sets the rules that the Business Owners must follow, and the Card Networks are responsible for enforcement of those rules.

Card Networks have the ability to Fine Business Owners who are not in compliance with the Rules and Federal Laws and in some cases can Prevent Business Owners from accepting Future Card Payments.

How Does Card Processing Work?

The Flow of Card Processing is in place to protect Card Users and Banks from fraudulent charges.

- The Card Networks, use “Gate Keepers” to make sure ALL of the Card Network’s rules are being followed.

- Gate Keepers are large Regulated Banks such as: Esquire Bank, Wells Fargo, US Bank, etc, and the Gate Keeper’s job is make sure the Business Owner is a legitimate business and does not use Card Processing in a fraudulent manner. Gate Keepers use “Card Processing Companies” to find Businesses to provide Card Processing To;

- The Card Processing Companies such as: Defyne Pay, Paybright, Banc Certified, Mainstream, Hartland, etc, use and regulate “Card Processing Agencies” and are held responsible if a Card Processing Agency or their Processing Agents makes a mistake;

- Card Processing Agency is what “Trifinity Merchant Services” is. A Card Processing Agency is responsible for (1) recruiting Sales Agents, (2) training those Sales Agents, (3) submitting the applications to the Card Processing Company and (4) is tasked with locating the correct card processing system for the Business Owners and (5) is the main contact for the Business Owner for Customer Service.

- Card Processing Agent is the “Sales Agent”, who actually makes the sales to Business Owners to use their Card Processing.

How Do Card Processing Agents Get Paid?

There are Card Processing Fees Charged to the Business Owner every time a purchase is made. These charges can range from as little as .005% (1/2 of 1%) for regulated Debit Cards, to .10% (10 percent) for Rewards Credit Cards.

Following are approximate NET distribution of Processing Fees. This will vary based on the card type being used:

(Rewards on Rewards Credit Cards are for the most part paid to the Issuing Bank and the Customer.)

For this example we will assume the Processing Fee is $10.

- Card Network – 2% or 20 cents;

- Gate Keepers – 10% or $1;

- Card Processing Company – 18% or $1.80;

- Card Processing Agency -35% or $3.50

- Card Processing Agent 35% or $3.50

In Dollars and Cents What Does This Mean To The Sales Agent!

Since currently the National Average Fee for Cash Discounting Card Processing is 3 1/2%;

Every time a Business makes a sale, the Card Processing Agent who enrolled a Business for Card Processing earns on the average 1/3 of 3.5% of the sale or approximately 1% of the sale!

Every time the Business has $100 in sales the Agent makes $1.00.

A Business with $25,000 in monthly sales earns the Agent an average of $250 in Commissions each month!

This is Residual Income and the Commissions continues as long as the Agent has the account!

Trifinity Merchant Services Offers All

Three Kinds of Card Processing

Business Owners Now Have Three Different Types of Card Processing To Choose From:

I. Traditional Card Processing

In 1958 when Bank of America first began what was to become Visa, and other banks started what was to become Master Card, they didn’t want anything to inhibit Card Users from using their Credit Cards and then later Debit Cards. After all Credit Cards are basically a way for Banks to make a “Personal Loans” from the Bank issuing the Credit Card to the Card Holder.

So the Card Networks had a rule against the Business Owners charging to recover their cost to accept Card Payments. This is called “Traditional Card Processing”, and with Traditional Card Processing the Business Owner pays all of the fees that are charged for Card Acceptance.

The Card Networks even convinced Business Owners that passing the Fees was not only against the rules, but it also would cost the Business Owner Customers.

If a Business Owner want to continue paying all of the Card Processing Fees, Trifintiy Merchant Services Guarantees the Lowest Rates in the Card Processing Industry.

Understanding What Enabled

Credit Card Surcharging and Cash Discounting

Following the banking reforms of the New Deal up until 1980 was marked by a relative degree of banking stability and economic expansion.

In 1980 Congress passed the Depository Institutions Deregulation and Monetary Control Act, which served to deregulate most Financial Institutions, while giving the Fed’s more control over monetary policy.

The subprime mortgage meltdown that began in 2007, and failures of banks deemed “too big to fail” caused the government to rethink the financial regulatory framework. In response to the crisis, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act, better known as The Banking Reform Act, in 2010.

Part of the Banking Reform Act was the Durbin Amendment.

The Durbin Amendment:

- Limits Regulated Banks to only charging 21 cents plus .05% for Personal Debit Cards. (Regulated Banks have more than 1 Billion Dollars in Assets.)

- Enabled Business Owners to recover the cost of accepting Credit Cards by Surcharging.

- Put the maximum Fee Business Owners could charge to accept Credit Cards at 4%.

- Enabled Business Owners to charge one price for Card Payments and another price for Cash Payments, called Cash Discounting. Business Owners are not allowed to charge Card Paying Customers more than 4%. more than Cash Paying Customers are charged.

- If a Business Owner is either Surcharging or giving a Cash Discount, the Business must post Customer Notification at the point of entry into the Business and at the point of Payment.

II. Credit Card Surcharging

If a Fee is Added to any Card Purchase it is called “Surcharging”. Following are the rules for Surcharging:

- The Business Cannot charge more than they are charged;

- The fee cannot exceed 4%;

- The Fee must be printed on the receipt as a separate charge;

- The Processing Machine must be able to differentiate between a Debit Card and a Credit Card;

- A Business cannot discriminate between Card Brands and charge a different price based on the Card Brand;

- With Surcharging a Fee for accepting Credit Cards can be charged but a fee cannot be charged to a Debit Card;

- Customer Notification be placed at point of entry and at the Point of Sale,

Failure to follow all of the Rules can result in Fines for the Business Owner.

III. Cash Discounting

When the Banking Reform Act with the Durbin Amendment first passed in 2010, Banks immediately filed legal actions that went all the way to the United State Supreme Court, on January 25, 2015 the US Supreme Court ruled the Banking Reform Act with the Durbin Amendment was Constitutional and effective January 26, 2015 Business Owners could began recovering their card fees cost.

Because Congress was so specific about Surcharging, Business Owners started recovering their cost for Credit Card acceptance, however due to further court rulings, that allowed Business Owners to charge one price for Cash Payments and another cost for Card Payments “Cash Discounting” flourished and now an estimated 38 percent of all Businesses in the United States utilize Cash Discounting.

IV. New Card Concept

While one of the Federal Durbin Amendment Guidelines state: “The Business Cannot charge more than they are charged”, there is not anything against paying a commission to a Business Owner for their services.

New Card Concept combines utilizing a Business Owner’s Card Processing with what we call an “Introduction Commission” and an Infinite Banking Account which will enable the Business Owner to start saving for the Retirement by accepting Trifinity Card Processing.

An Introduction Commission is earned by a Business Owner every time a Card Payment is made, paid directly into their Infinite Banking Retirement Account for an Introduction to 5 other Business Owners that they know!

How it works: The Business Owner provides 5 Leads of Business Associates to the Agent and instead of charging 3.5% to accept the card payment the fee is raised to 4%.

The Business Owner can then have the difference paid to them as an “Introduction Commission” directly into their Infinite Banking Retirement Account.

II. Types of Card Processing Machines

It doesn’t matter what type of Card Processing System a Business Owner needs, Trifinity Merchant Services has it! There are various types of credit card processing machines, and each offers unique benefits.

Some of the most common types of credit card terminals are:

Countertop Terminals

Countertop Terminals – Countertop terminals are best for a brick-and mortar-store or office where you check out customers. A Business Owner can expect to pay $100-$350 or more, depending on the brand, model and features.

This is a Dejavoo Z 11 Processing Machine, recently installed by Trifinity Merchant Services.

Mobile Terminals

Mobile Terminals – Mobile Terminals rely on a wireless connection through Wi-Fi, a phone or a tablet to process card payments on the go.

This means they are portable and can be moved around in a store, or even taken out to events and they usually have a sleek design.

The downside to mobile terminals is security. Since payment information is sent wirelessly, there is some concern that it may be intercepted.

This is a Swipe Simple Mobile Terminal with Card Data Encryption insuring security for the transaction!

Virtual Terminals

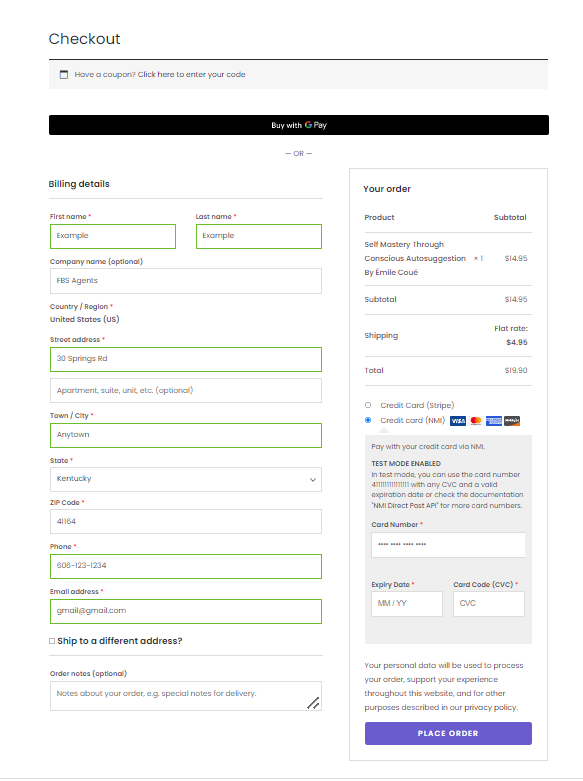

Virtual Terminals – Virtual Terminals allow your e-commerce business to process credit and debit cards by entering the payment information into a secure website.

A client’s card does not need to be present to process this type of transaction.

Benefits to using virtual terminals:

- Cards optional: You can run your business virtually and still process credit card transactions with this type of system.

- Complete mobility: No credit card processing device or accessories are necessary, so you don’t need to pay additional costs.

Integrated Point-of-Sale (POS) Systems

Integrated point-of-sale (POS) systems. A POS System not only enables a Business Owner to run a Card Processing Payment but also at the same time enables a Business Owner to:

- Track Sales!

- Manage Employees!

- Do Inventory!

One of the Leaders in the POS market is Clover and Trifinity Agents can offer Clover POS systems to their customers.

The History of Card Processing

In The Card Process Business Knowledge Is King!

To Be Successful…

Agents Need To Know About The History of Card Processing

There are basically 3 different cards, Card Users utilize to make purchases.

- Debit Cards;

- Charge Cards;

- Credit Cards

When someone deposits their money in a bank or some other form of banking institution such as a credit union, they can either:

- Go to the “bank” and make cash withdrawal,

- Arrange a money wire;

- Write a check;

- Use a debit card.

- Debit Cards

Over the years debit cards have become the most widely used form of making a withdrawal for someone’s account.

The debit card can be used to withdraw money or make purchases up to the amount the debit card user has on deposit in their account.

- Charge Cards

A charge card works a lot like a credit card except charge cards must be paid off the next month after the purchase has been made. Probably the best known Charge Cards are American Express and Dinner’s Club.

- Credit Cards

A credit card is a payment card issued to users/cardholders to enable the cardholder to pay a business for goods or services. The card issuer grants the card user a line of credit, for as little as $100 up to $10,000 or more.

When someone uses a credit card, the credit card issuer usually a bank, pays the business for the purchase and the card holder pays the bank back.

Unlike a charge card that has to be paid off every month, the credit card user can make payments on the charged amount with accrued interest, often 20% to 25% or more, plus fees, such as statement fees, annual renewal fees, and late fees etc. for the use of the credit card.

The History of How Card Processing Has Evolved

“It is better to know something and not need it, than it is to be asked a question about something and not have a clue what you are being asked about”.

I. Charge Coins

They came in various shapes and sizes, and they were made out of various materials such as celluloid, (a type of plastic), copper, aluminum, steel, and other types of whitish metals.

Each “charge coin” usually had a little hole, enabling it to be put in a key ring, like a key.

These charge coins were usually given to customers who had charge accounts in department stores, hotels, and so on. A charge coin usually had the charge account number along with the merchant’s name and logo.

This charge coin offered a simple fast way to copy a charge account number to the sales slip, by imprinting the coin onto the sales slip.

A big draw back was the customer’s name was not on the charge coin, so anyone could use it. This sometimes led to a case of mistaken identity, either accidentally or intentionally, by acting on behalf of the charge account owner or out of malice to defraud both the charge account owner and the merchant.

II. Charga-Plate

Charga-Plate

The Charga-Plate was developed in 1928 and was an early predecessor of the credit card.

The Charga-Plate was also issued by large department stores and hotels and the biggest improvement was it was embossed with the customer’s name, city, and state. It held a small paper card on its back for a signature.

Usually the plates were kept in the issuing store rather than held by customers.

III. Charge Cards

In 1934, American Airlines and Air Transport Association started Charge Cards.

This card had a numbering system that identified the issuer of the card as well as the customer account. With an Air Travel Card, passengers could “buy now, and pay later” for a ticket against their credit and receive a fifteen percent discount at any of the accepting airlines.

By the 1940s, all of the major U.S. airlines offered Air Travel Cards that could be used on 17 different airlines.

By 1941, about half of the airlines’ revenues came through the Air Travel Card agreement. The airlines had also started offering installment plans to lure new travelers into the air.

In October 1948, the Air Travel Card became the first internationally valid charge card within all members of the International Air Transport Association.

General purpose charge cards: Diners Club, Carte Blanche, and American Express

The concept of customers paying different merchants using the same card was expanded in 1950 by Ralph Schneider and Frank McNamara founders of Diner’s Club.

The Diners Club, which was created partially through a merger with Dine and Sign, produced the first “general purpose” charge card and required the entire bill to be paid with each statement.

That was followed by Carte Blanch and in 1958 by American Express which created a worldwide credit card network. These cards were initially charge cards that later acquired credit card features.

III. Credit Cards

VISA

In September 1958, Bank of America launched the BankAmericard in Fresno California and this became the first successful recognizably modern credit card.

This card succeeded where others failed by breaking the chicken-and-egg cycle in which consumers did not want to use a card that few merchants would accept and merchants did not want to accept a card that few consumers used.

Bank of America chose Fresno because 45% of its residents used the bank, and by sending a card to 60,000 Fresno residents at once, the bank was able to convince merchants to accept the card.

BankAmericard started licensing other banks to issue their cards beside Bank of America, and by 1968 there were 6 banks licensed to issue BankAmericard.

In 1976, all BankAmericard licensees united themselves under the common brand VISA.

Master Card

In 1966, the ancestor of Master Card was born when a group of banks established Master Charge to compete with BankAmericard; it received a significant boost when Citibank merged its own Everything Card it had launched in 1967, into Master Charge in 1969.

Credit Cards After 1970

Until it was outlawed in 1970 bank credit cards were mass-produced and mass mailed unsolicited to bank customers who were thought to be good credit risks.

They have been mailed off to unemployable people, drunks, and narcotics addicts and to compulsive debtors. These mass mailings were known as “drops” in banking terminology, and were outlawed in 1970 due to the financial chaos they caused.

However, by the time the law came into effect, approximately 100 million credit cards had been dropped into the U.S. population.

After 1970, only credit card applications could be sent unsolicited in mass mailings.

Before the computerization of credit card systems in America, using a credit card to pay at a merchant was significantly more complicated than it is today.

Each time a consumer wanted to use a credit card, the merchant would have to call their bank, which in turn had to call the credit card company, which then had to have an employee manually look up the customer’s name and credit balance.

This system was computerized in 1973 allowing transaction time to decrease substantially to less than one minute.

However, until always-connected payment terminals became ubiquitous at the beginning of the 21st century, it was common for a merchant to accept a charge, especially below a threshold value or from a known and trusted customer, without verifying it by phone.

Books with lists of stolen card numbers were distributed to merchants who were supposed in any case to check cards against the list before accepting them, as well as verifying the signature on the charge slip against that on the card.

Merchants who failed to take the time to follow the proper verification procedures were liable for fraudulent charges, but because of the cumbersome nature of the procedures, merchants would often simply skip some or all of them and assume the risk for smaller transactions.

IV. Post September 11th 2001

Up until September 11, 2001 card processing still often took 3 to 4 days to process.

Banks rely heavily on incoming payments from other banks to fund their own payments.

The terrorist attacks of September 11, 2001, destroyed facilities in Lower Manhattan, leaving some banks unable to send payments through the Federal Reserve’s Fedwire payments system. As a result, many banks received fewer payments than expected, causing unexpected shortfalls in banks’ liquidity.

These disruptions also made it harder for banks to redistribute balances across the banking system in a timely manner.

During the days following the attacks required significant injections of liquidity by the Federal Reserve, first through the discount window and later through open market operations, were important in allowing banks to reestablish their normal patterns of payments coordination.

Congress required Banks to develop faster Card Processing and as a result today, Card Processing happens almost instantly.

Congratulations

After reading this you now know as much about Card Processing, or more, than other Card Processing Agents.